s corp tax calculator nyc

More than 100000 but not over 250000. The S Corp Tax Calculator.

You Can Rely Upon Our Professional Expertise Small Business Funding Stock Market Business Funding

If New York City Receipts are.

. If your business is incorporated in New York State or does. Ad Payroll So Easy You Can Set It Up Run It Yourself. A What is your.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Sovos managed services makes sales tax filing easier for online sellers and merchants. All shareholders who earn wages or a salary from a C Corporation must pay self-employment tax.

Like the states tax system NYCs local tax rates are progressive and based on income level and filing status. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax. Choose Avalara sales tax rate tables by state or look up individual rates by address.

We are not the biggest. Partnership Sole Proprietorship LLC. The net income from the S corporation passes through to the business owners and New York also taxes this income.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Ad Our tax preparers will ensure that your tax returns are complete accurate and on time. More than 250000 but not over 500000.

Calculating Your S-Corp Tax Savings is as Easy as 1-2-3. Fixed Dollar Minimum Tax is. S-Corp or LLC making 2553 election.

Not more than 100000. For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator.

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. Choose Avalara sales tax rate tables by state or look up individual rates by address. Ad Form An S Corporation Online With Worry Free Services Support To Start A Business.

S Corp Tax Savings Discover possible tax savings by comparing S Corp to LLCs in your state. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Forming an S-corporation can help save taxes.

If your business is incorporated in New York State or does. This guide will quickly teach you the major mechanics of how your taxes and this tax calculator. New York has a flat corporate income tax rate of 7100 of gross income.

Tax Bracket gross taxable income Tax Rate 0. Effective for tax years beginning on or after January 1 2015 the general corporation tax GCT only applies to subchapter S corporations and qualified subchapter S subsidiaries under the. 10 -New York Corporate Income Tax Brackets.

1 Select an answer for each question below and we will calculate your S-corp tax savings. There are four tax brackets starting at 3078 on taxable income up to 12000. This calculator helps you estimate your potential savings.

More than 500000 but. This calculator helps you estimate your potential savings. For example if you have a.

The S Corporation tax calculator below lets you choose how much to withdraw from your business each year and how much of it you will take as salary with the. However if you elect to. New York Estate Tax.

From the authors of Limited Liability Companies for Dummies. The SE tax rate for business owners is 153 tax. Being Taxed as an S-Corp Versus LLC.

Check each option youd like to calculate for. Federal Taxes for C Corps. State tax rates on personal income range from 4 to.

Work With Our Trusted Team To Quickly Form Your S Corporation Online. This tax is administered by the Federal Insurance Contributions. This could potentially increase the S-corp tax bill significantly and.

10 -New York Corporate Income Tax Brackets. Sovos managed services makes sales tax filing easier for online sellers and merchants. New Yorks estate tax is based on a.

C-Corp or LLC making 8832 election. Taxes Paid Filed - 100 Guarantee. Shareholders pay New York tax on their pro rata share of the S corporation pass-through items of income gain loss and deduction that are includable in their federal adjusted.

Information on this page relates to a tax year that began on or after January 1 2021 and before January 1 2022. S corp vs llc tax savings calculator. Ad Our tax preparers will ensure that your tax returns are complete accurate and on time.

You can also use our New York property tax calculator to find out what you would pay in property taxes in New York. Taxes Paid Filed - 100 Guarantee. Forming an S-corporation can help save taxes.

For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes. However one major difference from c corporations is that the new york city s corporation tax rate is a flat 885as opposed to a range of 65 to 885.

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

New York S Pass Through Entity Tax Rate Now Available To Owners Of S Corporations And Partnerships Grassi Advisors Accountants

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

New York State Pass Through Entity Tax Sciarabba Walker Co Llp

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

New York State Enacts Tax Increases In Budget Grant Thornton

Student Information Card Template New Frozen Bank Accounts New Economy Project Best Templates Ideas Bes Credit Card Online Bank Account Student Information

5 Benefits Of Becoming An S Corporation

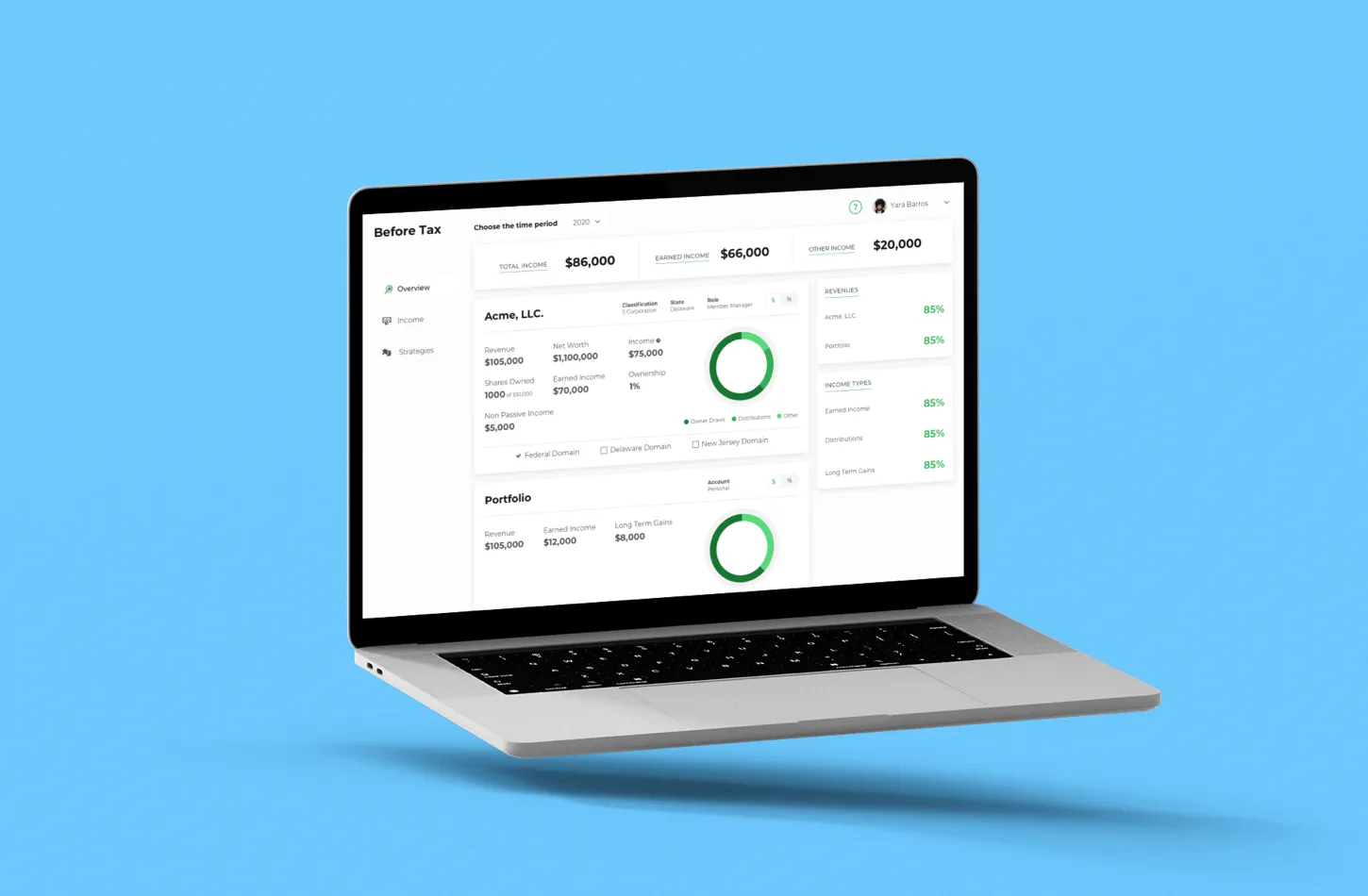

S Corp Business Filing And Calculator Taxhub

State Corporate Income Tax Rates And Brackets Tax Foundation

What Is The Federal Supplemental Tax Rate Turbotax Tax Tips Videos

Free Credit Dispute Letters Credit Repair Secrets Exposed Here Credit Repair Letters Credit Dispute Credit Repair

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Right Of First Refusal Work In Nyc Hauseit Right Of First Refusal Buying A Condo Nyc

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

2022 Income Tax Brackets And Standard Deduction

New York Tax Rates Rankings New York State Taxes Tax Foundation