fsa health care limit 2021

Jan 01 2021 Health Care FSA Maximum Plan Limit. Jan 01 2021 Included in the announcement is the inflation adjusted 2021 limits for Health Care flexible spending accounts FSAs under an IRC 125 cafeteria plan.

Kirkland Signature Usda Organic Multivitamin 80 Coated Tablets In 2021 Organic Multivitamin Usda Organic Multivitamin

Monday March 7 2022.

. IRS Announces Health FSA Limits for 2021 October 28 2020 Employee Benefits On Monday October 26 2020 the Internal Revenue Service IRS released Revenue Procedure 2020-45 which officially maintained the maximum Health Flexible Spending Account FSA contribution limit at 2750 for calendar year 2021. As a result the maximum Health Care FSA rollover limit of 550 will remain unchanged for plans that begin or renew on or after January 1 2021. If youre married your spouse can put up to 2750 in an FSA with their employer too.

Employers may continue to impose their own dollar limit on employee salary reduction contributions to Health FSAs. 2021-R-0054 February 11 2021 Page 3 of 4 unused health and dependent care FSA funds are forfeited at the end of the plan year known as the use it or lose it rule IRS Notice 2005-42. Keep in mind the following.

Now employees may be able to carry over all of their unused health funds from 2021 into 2022 if their workplace opted into the changes according to the IRS this is also true for dependent care. The limit is per person. Depending on a few factors like where you live and your total income you could save anywhere from 35 to 46 percent on the funds you place in a dependent care FSA.

Get a free demo. Dependent care fsa limit 2021. The minimum annual election for each FSA remains unchanged at 100.

Total contributions for both the employer and employee cannot exceed 5000 for. For plan year 2022 in which the HCFSALEXHCFSA contribution limit is 2850 employees can carry over 20 percent of 2850 or 570 to the 2023 plan year. Child Elderly Dependent Care.

It remains at 5000 per household or 2500 if married filing separately. But employers may offer either a grace period or a carryover but not both to health FSA participants under certain circumstances. Easy implementation and comprehensive employee education available 247.

On October 26 2020 the Internal Revenue Service IRS released Revenue Procedure 2020-45 which maintains the health flexible spending account FSA salary reduction contribution limit from 2020 which is 2750 for plan years beginning in 2021. Provides flexibility for the carryover of unused amounts from the 2020 and 2021 plan years. 2020-43 set the 2021 employer contribution limit for excepted-benefit hras while notice 2020-33 increased the health fsa limit on 2020 carryovers to the 2021 plan year with future carryovers capped at 20 of the maximum employee pretax contribution to a health fsa for a plan year.

2020-45 keeps the limit at 550 for 2021 health. The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022. Provides flexibility to adopt.

Ad Professional Benefits Services. The Health Care FSA pre-tax salary reduction limit is per employee per employer per plan year. Child Elderly Care FSA.

Provides flexibility to extend the permissible period for incurring claims for plan years ending in 2020 and 2021. For spouses filing jointly each spouse can elect up to the health care max in the year in 2022 that would be 2850 2850 5700 household total. If you would like to increase your 2022 contribution amount to the new allowed limit you must email the Benefits Service Center at benefitsjhuedu no later than Dec.

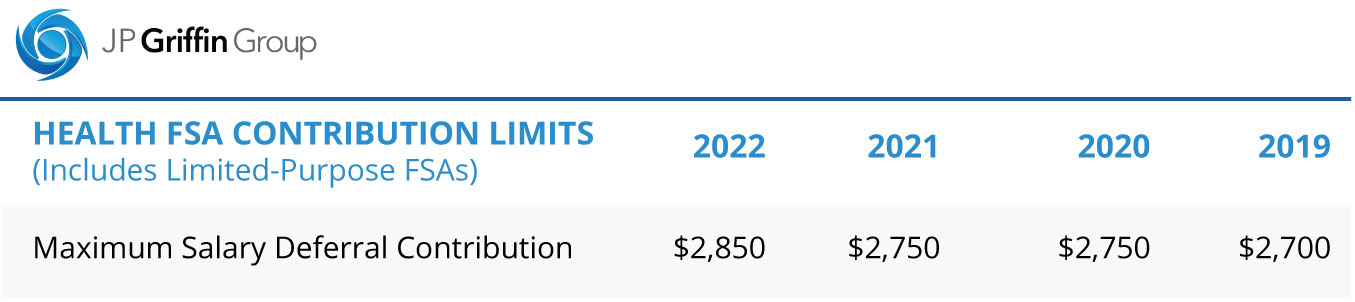

This is an increase of 100 from the 2021 contribution limits. FSAs are limited to 2750 per year per employer. Your employer may elect a lower contribution limit.

For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. Dependent care FSA increase to 10500 annual limit for 2021 June 17 2021 On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden. However carry over amounts have increased from 500 to 550 for any excess balance at the end of 2021 to be carried over into plan year 2022.

Meanwhile the limit on contributions to dependent-care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in March. Employees in 2021 can again put up to 2750 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced. What this means.

Notice 2021-15 provides flexibility for employers in the following areas related to health FSAs and dependent care assistance programs. Ad Custom benefits solutions for your business needs. Elevate your health benefits.

You can use funds in your FSA to pay for certain medical and dental expenses for you your spouse if youre married and your dependents. The health FSA contribution limit will remain at 2750 for 2021. The 2750 limit for 2021 applies on a per FSA account basis and could be less than 2750 if your employer chooses.

Most notably this included a projection of no changes to the 2021 Health Care FSA Limit for a continued annual maximum of 2750 per plan year. ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only. For married couples filing joint tax.

2750 is the IRS max you can elect for your FSA in 2021 but if you switch jobs mid-year regardless of claims incurred you can start fresh with a new FSA with your new employer. 5000 2020 2021 2022 2500 2020 2021 2022 Health Care. Emilys Form W-2 should report 5200 of dependent care assistance in box 10 4500 FSA plus 700 on-site dependent care.

The pre-tax salary reduction limit for Health Care FSAs will remain at 2750 for plan years on or after January 1 2021. Thus for health FSAs with a carryover feature the maximum carryover amount is 550 20 of the 2750. Each spouse in the household may contribute up to the limit.

The IRS recently announced that the 2022 limit for health care and limited purpose flexible spending accounts or FSAs is 2850 up from 2750 in 2021. Beginning January 1 2021 Health FSA contributions are limited by the IRS to 2750 each year this remains unchanged from the 2020 limit of 2750.

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance

Best Deals And Coupons For Fsa Store Baby Health Health Fitness Diet

2021 Flexible Spending Account Other Limits Flexible Benefit Service Llc2021 Flexible Spending Account Other Limits

Waterpik Evolution And Nano Water Flosser Combo Pack In 2021 Water Flosser Waterpik Waterpik Water Flosser

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

How To Build Windbelt Wind Generator For 5 Using Vhs Tape Wind Generator Diy Wind Turbine Wind Turbine

Fsa Open Enrollment 24hourflex

Best Deals And Coupons For Fsa Store Baby Health Health Fitness Diet